child tax portal phone number

Taxation Self-Service Portal Help. The Child Tax Credit CTC provides financial support to families to help raise their children.

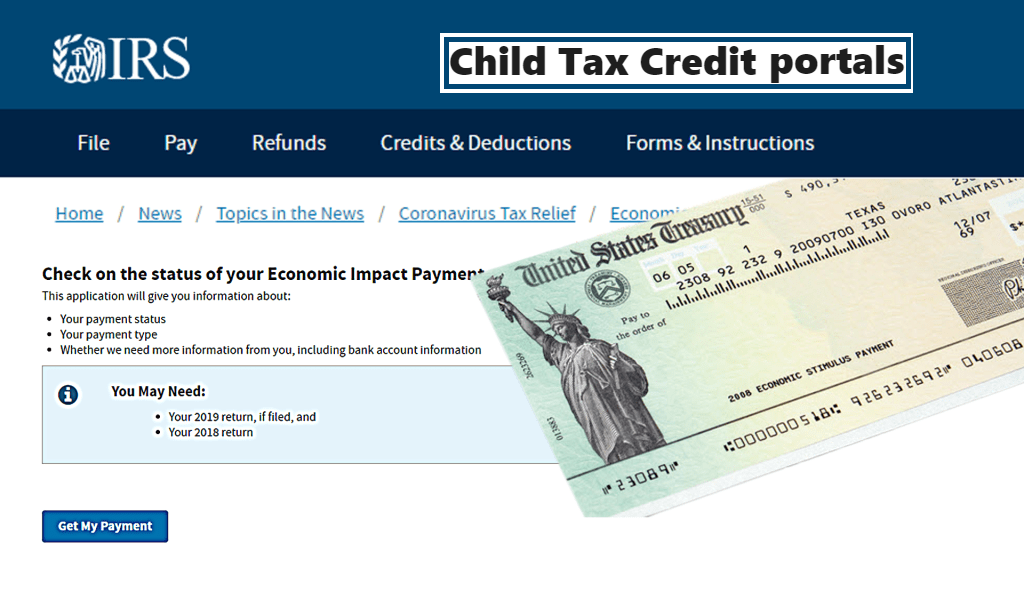

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Already claiming Child Tax Credit.

. Call the IRS about. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls.

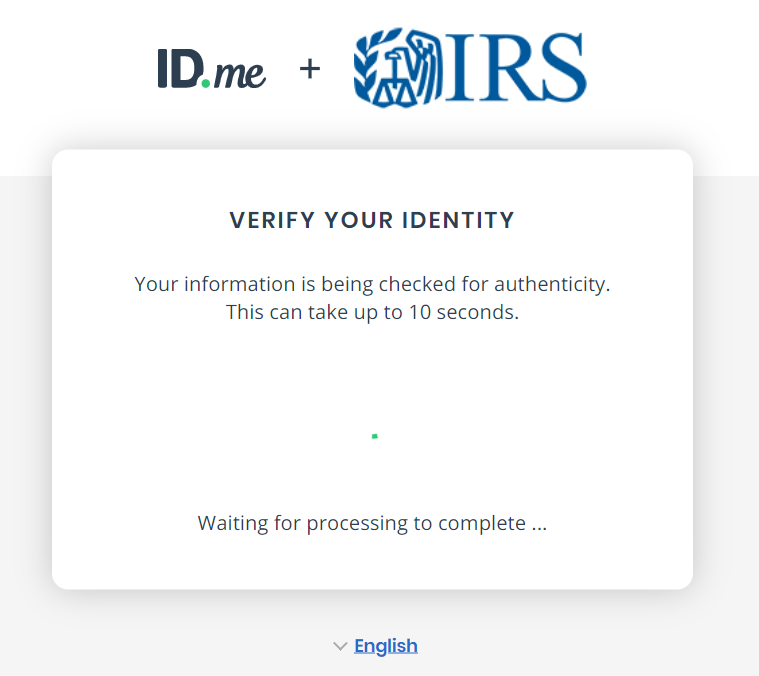

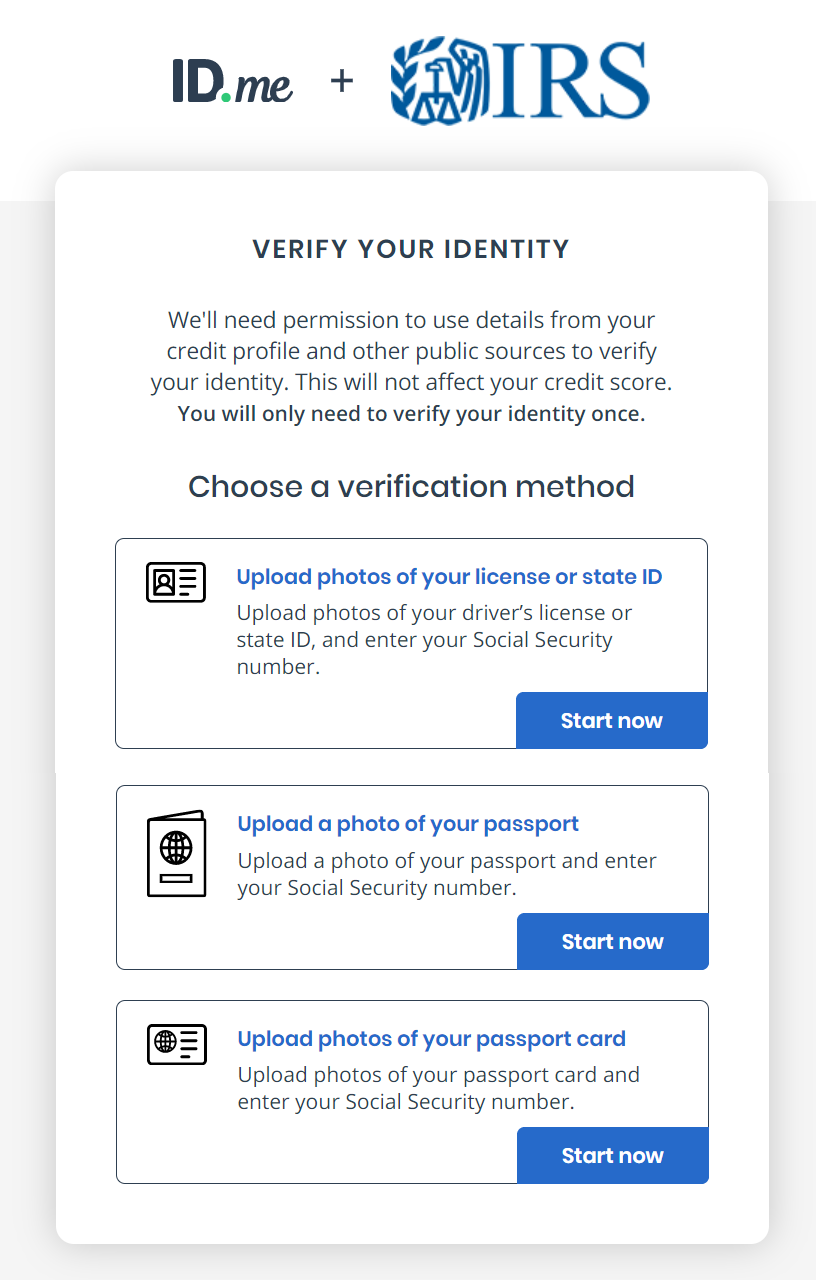

IMPORTANT INFORMATION - the following tax types are now available in myconneCT. Page 1 of 1 2022 Child Tax. Creating an account for the CTC UP portal takes 20-30 minutes to complete if you have everything listed below.

Overview The American Rescue Plans expansion of the Child Tax Credit will reduced child poverty by 1 supplementing the earnings of families receiving the tax credit and 2 making. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially. It is a tax law resource that takes you through a series of questions and provides you with responses.

Do not use the Child Tax Credit Update Portal for tax filing information. For the September 30 2021 Advance. The number to try is 1-800-829-1040.

For example if you call the IRS business phone number you wont get the answer youre looking for as the representatives at the end of the line arent going to have them. Making a new claim for Child Tax Credit. You can see your advance payments total in.

Make sure you have the following information. Child tax portal phone number Wednesday March 30 2022 Edit. The amount you can get depends on how many children youve got and whether youre.

Creating an account to access the Child Tax Credit Portal. The Child Tax Credit Update Portal is no longer available. Child Tax Credit.

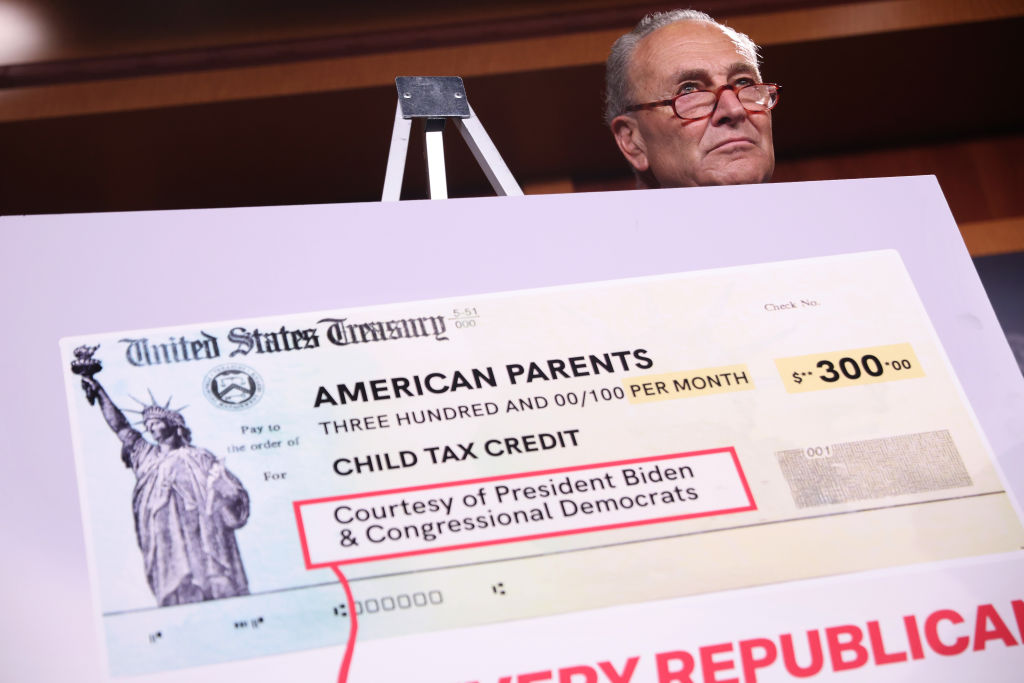

Individual Income Tax Attorney Occupational Tax. Including PIN requests setting up an online account filing a return on the Portal or making a Portal payment. Many families received advance payments of the Child Tax Credit in 2021.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. For all other tax law inquiries visit the Interactive Tax Assistant on irsgov.

Child Tax Credit Latest How To Use The Irs S Update Portal Cbs Philadelphia

Irs Child Tax Credit Portal Open For Parents Who Want To Opt Out Of The Monthly Payments 5newsonline Com

Dependent Children 2021 Tax Credit Jnba Financial Advisors

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

Have Questions About The Advance Child Tax Credit Legal Aid

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

Child Tax Credit Update Portal 1 Tool To Check If You Re Eligible For 300 Per Child Payment Itech Post

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Internal Revenue Service Launches Web Portal For Child Tax Credit Giving Non Filers Four Weeks To Declare Eligibility

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit What To Do If You Haven T Gotten Your Payment Yet

How To Apply For The Child Tax Credit With The Irs Non Filer Sign Up Tool Youtube

Irs Adds Address Change Capability To Child Tax Credit Portal Where S My Refund Tax News Information

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Child Tax Credit Update Portal Internal Revenue Service

/cdn.vox-cdn.com/uploads/chorus_asset/file/22733126/1233995610.jpg)

How To Get The Child Tax Credit And Why It Should Be Easier To Get Vox

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back